People are spending a lot of time playing video games these days, such as FIFA 15 and Call of Duty, which are both popular video game world-wide, more FIFA 15 News and Guides on Runeme.com. You should reall know Electronic Arts and Activision Blizzard, if you are a game lover.

Electronic Arts (NASDAQ: EA ) saw gameplay hours for Madden NFL 15 jump 30% last quarter as compared to the prior year. And gamers spent an average of three hours per day playing Destiny in the first few months after launch, according to publisher Activision Blizzard (NASDAQ: ATVI ) .

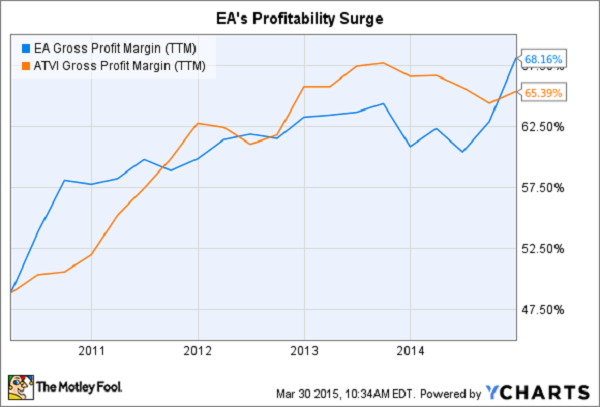

Those banner engagement figures powered a massive profit spike at both gaming companies. EA managed an all-time high 68% profit margin last quarter, while Activision posted 51% higher earnings — a record $1.42 per share. But whereas EA shares surged by over 100% in the past year, Activision stock has hardly budged.

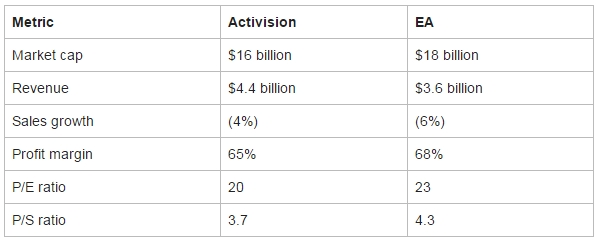

So, does that make the owner of the Call of Duty and Skylanders franchises the obvious investment choice from here? Let’s compare the two biggest publishers in the video game industry, starting with a few key statistics:

Broadly speaking, Activision looks like the cheaper investment. You can buy it at a discount to EA whether you are considering price-to-earnings or price-to-sales multiples. In fact, Activision has EA beat on all of the major metrics except one: profitability.

Electronic Arts is winning the digital war

Profitability has been the main driver behind the amazing gains EA shares have enjoyed the past year. Gross profit margin is up from 58% of sales in 2011 to a projected 71% this year. The company even beat its larger rival on this key metric last quarter.